52+ why isn't my mortgage interest deductible this year

Both of you should attach. Claiming the mortgage interest.

Work From Home Jobs Australia 52 Jobs You Can Do From Home Work With Joshua

Web You cant deduct home mortgage interest unless the following conditions are met.

. Web The interest portion of your monthly mortgage payment isnt the only type of interest youre permitted to deduct from your annual tax bill. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. This itemized deduction allows homeowners to subtract mortgage interest from their.

TurboTax automatically calculates if you should itemized your. Web Mortgage interest will only count towards deductions if you are itemizing your deductions. Web The mortgage interest deduction is a tax incentive for homeowners.

Web The mortgage interest deduction got a new limit One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. Web Up to 96 cash back A home mortgage is also called acquisition debt these are debts that are.

Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. Used to buy build or improve your main or second home and Secured by that home. You can also deduct.

Web You get no tax benefit from itemized deductions until all of them together add up to be more than your standard deduction. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040. Web Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage.

Is Homelessness As Bad In Canada As It Is In The Usa Quora

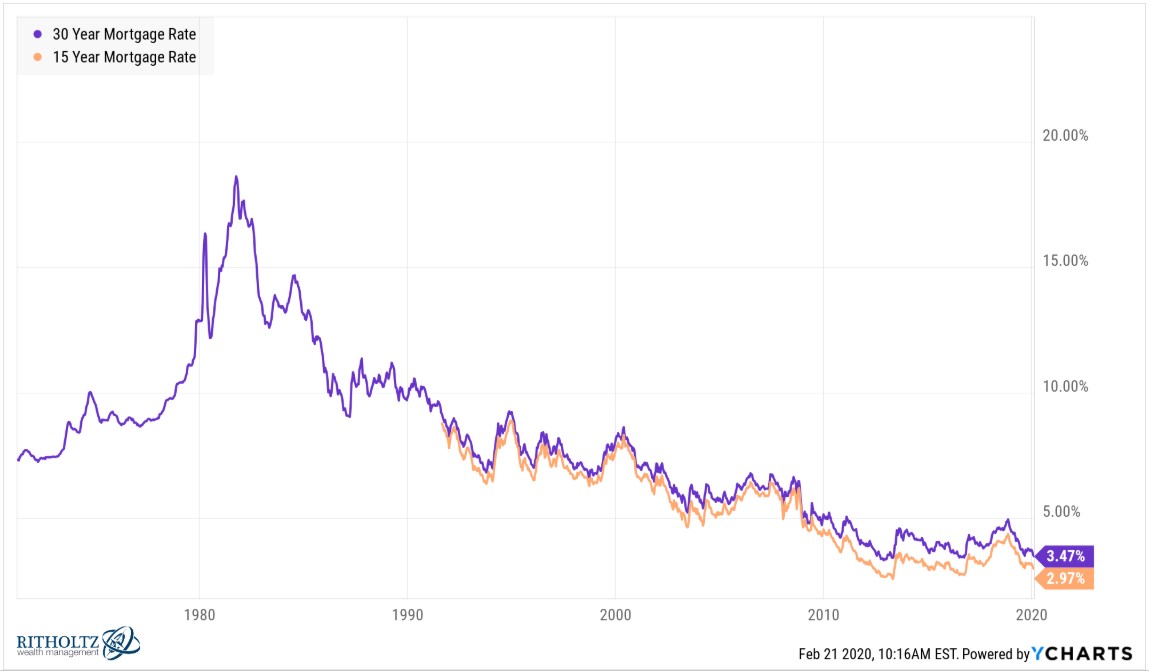

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Business Succession Planning And Exit Strategies For The Closely Held

Should You Pay Off Your Mortgage Early With Rates So Low

Propertync Magazine 71 By Propertync Magazine Issuu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Understanding The Mortgage Interest Deduction With Taxslayer

Is Mortgage Interest Deductible In 2023 Consumeraffairs

The Villager Ellicottville December 23 30 2015 Volume 10 Issue 52 By Jeanine Zimmer Issuu

Blog Ymm Residential Market Update

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Understanding The Mortgage Interest Deduction With Taxslayer

Rvnpb1wl9kytm

Why Your Mortgage Interest Tax Deduction Doesn T Really Help Much The Motley Fool

Mortgage Interest Deduction What You Need To Know For Filing In 2022 Business Salemnews Com

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners